The Art and Science of Downside Protection

“One can illustrate the strange concept of alternate histories as follows. Imagine an eccentric tycoon offering you $10m to play Russian roulette, i.e., to put a revolver containing one bullet in the six available chambers to your head and pull the trigger. Each realisation would count as one history, for a total of six possible histories with equal probabilities. Five out of six histories would lead to enrichment; one would lead to an obituary with an embarrassing cause of death. The problem is that only one of the histories is observed in reality; and the winner of $10m would elicit admiration and praise of some fatuous journalist.

Reality is far more vicious than Russian roulette. First, it delivers the fatal bullet rather infrequently, so that after a few dozen trials one forgets about the existence of a bullet, under a numbing false sense of security. Second, unlike a well-defined precise game, one does not observe the barrel of reality. One is thus capable of unwittingly playing Russian roulette – and calling it by some alternative ‘low risk’ game.”

Nassim Taleb, Fooled by Randomness (2001)

Introduction

When times are good, and share prices are rising, most companies appear to be high quality. Both managers and investors tend to overlook the sources of downside risk, and instead get seduced by ever rosier expectations of the future. It is only when bad times arrive that the true resilience and quality of a company is tested. Many risks seen as low probability before, become real, while sources of future upside disappear. As the passage quoted above illustrates, the human brain is not designed to correctly weigh probabilities and assess future downside risks.

This human behavioural bias gets worse because of poor incentive structures. The majority of companies listed on public stock exchanges suffer from a serious ‘principal-agent’ conflict. The interests of management teams as ‘agents’ are not aligned with the minority shareholders of the companies, because management’s compensation is often linked to short-term incentives. This short-term focus encourages managers to take excessive risks, and not to think enough about building resilience within a company.

Investment managers who buy a company’s shares suffer from a ‘principal-agent’ conflict of their own. Most investment managers operate within large institutional structures which are focused on growth in Assets Under Management (AUM). Instead of thinking about how to enhance risk-adjusted long-term returns for their clients, these firms get obsessed with short-term relative performance vs their peer group and the benchmark. Under this scenario, many investment managers focus purely on upside possibilities without thinking enough about downside risks. They look good when share prices go up, while not necessarily suffering the consequences if there is a permanent loss of capital to clients.

The Art and Science of Downside Protection

At Aikya, our purpose is to generate healthy long term returns with strong downside protection, following an investment approach that has proven itself over the last several decades. We have an absolute return mindset and a strong aversion to permanent loss of capital.

We think like ‘principals’ while managing client assets

Our firm is majority-owned by the investment team, who have a large proportion of their net worth invested alongside client capital. We are entirely investment driven. We do not want to be the biggest, but we do want to be the best at what we do. To achieve our purpose, we have strict capacity controls in place. We want to keep things simple at Aikya and intend to keep our focus on Emerging Markets. We are one investment team, based in one location, with a flat structure and collegiate culture. Keeping things simple maximises our focus and improves our investment performance.

We prefer to invest in companies with strong principal owners

Almost 80% of the Aikya Global Emerging Markets Strategy is invested in owner-led businesses. These are the people with ‘soul-in-the-game’ who are emotionally invested in their companies. The health of their business not only drives their net-worth, but also their entire sense of self-worth. A permanent owner-mindset enables them to make decisions which are likely to strengthen the business in the long-run. But simply finding owner-led businesses is not enough. We look for owners who have a strong sense of purpose, integrity, and practise best-in-class governance. An organisational culture which is aligned to the strategy is another important factor for us, as is the ability of these principal owners to demonstrate a history of disciplined and conservative capital allocation. Well-stewarded businesses improve with time, as they have an ability to evolve and better service their customers. They also typically thrive during macroeconomic downturns because they can behave counter-cyclically when times are tough.

We look for resilient franchises and strong financials

While all our companies are exposed to excellent long-term growth opportunities, we are not necessarily looking for the highest growth or the highest return businesses in our universe. Rather, the sustainability of growth and returns is lot more important to us. We eschew companies with leveraged balance sheets. We have a zero-tolerance policy on poor quality or questionable accounting. We tend to avoid companies where the accounts are not entirely transparent, or where we suspect aggressive accounting by the management team.

We observe strict valuation discipline

In order to achieve strong downside protection not overpaying for companies that we like is as important as not compromising on the quality of the companies we select. Using valuation as a guide, we regularly avoid the most popular parts of the market and are willing to invest in high quality companies that might be temporarily out of favour.

Sustainability thinking is ingrained in our approach

Aikya Global Emerging Markets Fund is an article 9 fund under the EU’s Sustainable Finance Disclosure Regulation (SFDR) rules. Sustainability thinking is highly integrated into our investment approach. We do not view sustainability as an additional ‘nice to have’ but instead as a crucial aspect of how we analyse quality, and more specifically how we assess opportunities and risks. If a company has a significant sustainable development impact in the community it is operating in, it not only has a longer runaway for future growth, but it is also less likely to attract regulation or possible expropriation from the host government. As highly risk-aware investors in these markets, sustainability thinking is another crucial tool for us to reduce downside risks while enhancing long-term returns.

We constantly obsess over various ways we could lose money

It is often impossible to tell whether many of the risks we worry about will ever materialise. What happens is just one of the several ‘alternate histories’ possible. However, if we think a risk in a company is big enough to cause a permanent loss of capital in any possible ‘alternate history’, we are happy not to own the company, even though that company may be regarded as high quality and a ‘safe investment’ in popular perception.

Performance Review

In absolute terms, the last 12 months have proven difficult for emerging markets investors, with the MSCI EM Index (measured in USD) returning -11.4% in the year to the end of March 2022. In this context, our strategy has proven to be relatively resilient as it is down 2.4% over this period. This is a relatively short period to judge our performance. Nevertheless, we are pleased that the strategy has been able to preserve capital during a period of market weakness.

The strategy has returned 14.6% returns in USD terms since its inception in March 2020, vs MSCI Emerging Markets Index returns of 4.4% during the same period.

Performance contribution over the past 12 months came from a diverse range of companies across sectors such as Information Technology, Financials, Industrials and Communication Services. Our positions in India, Taiwan and Mexico contributed positively. The biggest detractors were the holdings in China, Hong Kong and the Philippines.

Russia

Aikya Global Emerging Markets strategy has not held any Russian company since its inception. Over the years, we have analysed every listed Russian company, and none of them passed our Quality tests. We are looking for honest owner-led businesses, which have been built on their own, without any help from politicians or the State. None of the listed companies in Russia meet this criterion as they are either linked to the President or the Russian state itself.

Our reluctance to invest in Russia might have sounded overly cautious in the past, but it was simply a result of our bottom-up stewardship analysis. For the same reasons, we have struggled to find high quality companies in countries like Saudi Arabia and Turkey where the lack of independent institutions and rampant crony capitalism make it nigh on impossible for honest and genuinely private entrepreneurs to do well.

Portfolio Positioning and Outlook

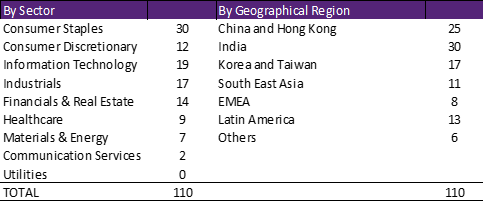

Aikya portfolio construction process is designed to maximise risk-adjusted returns for our clients by imposing strict valuation discipline and ensuring sufficient level of diversification. The Aikya Portfolio consists of 30-35 sensibly priced companies selected from the Aikya Quality List (QL).

Country allocation

Our investment process is entirely bottom-up. We are primarily focused on company research, and do not attempt to second guess macroeconomic forecasts. Our belief is that a portfolio of well-managed high quality businesses is likely to compound capital irrespective of what happens to the economy, as strong businesses tend to get stronger with every downturn.

However, we struggle to find investment ideas in countries where factors crucial to long-term sustainable economic development are missing. Accordingly, we are unlikely to invest in companies operating in countries with weak rule of law, questionable respect for private property rights, and low-quality institutional structures.

We think about appropriate diversification at a portfolio level but do not find traditional GICS sector/country classification to be especially useful when it comes to thinking about diversification within Emerging Markets portfolios. Instead, we look at the long-term drivers of companies and try to diversify our portfolio based on these underlying drivers. For example, Banco de Chile which operates in a small resource-exporting economy like Chile is far more dependent on the resources cycle than to its Indian banking peer, Kotak Mahindra Bank, which is largely driven by the domestic drivers of the Indian economy.

China

The unconstrained nature of our portfolio construction is especially important in the context of Emerging Markets. Certain countries get very popular from time to time, which often results in bubble-like valuations in companies listed in these countries. We believe China was in such territory at the beginning of 2021 and has corrected over the last twelve months.

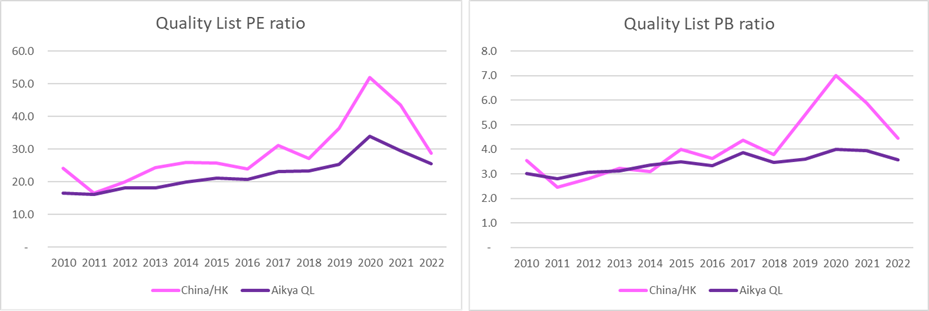

Source: Aikya research, Bloomberg, based on trailing 12 months financials

PE: Price to Earnings per Share; PB: Price to Book Value per Share

The Aikya Portfolio looks under-represented in China currently, but this is very much a tactical position due to the poor risk-reward of owning Chinese equities. We have been adding to our positions in China for the last 12-18 months as companies on our Quality List from China have become more reasonably valued. There are 25 companies from China on our Quality List.

Aikya Quality List

India

Indian companies on the other hand represent almost 22% of the portfolio, so it’s worth asking if we are taking too much risk on the macroeconomic situation in India. We do not think so, because half of our Indian positions are exporting businesses such as Tata Consultancy Services (TCS), and even the domestically exposed portfolio positions such as Marico have pricing power and are not particularly linked to macroeconomic cycles.

Sector Positioning

Given our focus on owning well-governed businesses, we tend to stay away from state-owned enterprises (SOEs) and politically connected businesspeople. We have a bias towards investing in businesses that are owned by genuinely private entrepreneurs. In our universe, this often drives us towards consumer sectors, and keeps us away from more cyclical, regulated and capital-intensive sectors such as Energy, Utilities and Materials.

Technology, Internet, and e-commerce stocks are under-represented in the portfolio at the moment, but largely due to valuation reasons.

Long-Term Outlook

We remain highly optimistic on the long-term prospects of Emerging Markets. Simply comparing major Emerging Markets against developed countries reveals that Emerging Markets countries have a population size 5x developed markets. They’re also likely to contribute almost as much to global GDP as the developed world by 2030, and yet their weight in the MSCI All Countries World Index is just 1/8th of the developed world. For long-term investors, we believe this is a great opportunity.