The Promise of Emerging Markets

Introduction

Strong downside protection while generating healthy long-term returns is the hallmark of our investment approach. We believe that the long-term compounding of portfolio returns is significantly enhanced when volatility is reduced, and the prospect of capital loss is minimised. It is worth asking why a lower-risk way of investing should be rewarded with higher returns? Does it not run counter to traditional finance theory?

At a stock level, there are two types of explanations for this apparent anomaly1. The first explanation, related to behavioural finance, states that investors regularly overestimate the payoffs and underestimate the risks of stocks with a ‘lottery’ type payoff profile (i.e. those stocks that offer huge upside with a small probability of success). These ‘lottery’ stocks often represent futuristic concepts and get extensive coverage in popular media, which makes investors overly confident in their abilities to predict the future profits for such companies. As a result, stocks with a high positive skew and high volatility become overvalued and then subsequently underperform2. For example, everyone wants to talk about and invest in a new EV technology company which might generate profits in 10 years’ time, but very few people care about a noodle business that has been steadily growing its profits for the past 30 years. A second set of explanations is linked to the constraints under which most institutional investors operate. Investors are generally forced to follow a benchmark, or adhere to certain portfolio risk parameters, which dictate that investors must buy these ‘lottery’ stocks, even though they might be expensive.

At a portfolio level, the explanation for this anomaly is simpler, and is based on the fact that what matters long-term is geometric compounding, not averaging of returns. The mechanics of geometric compounding are governed by the dispersion of returns and drawdowns; these are the key drivers of long-term investment outcomes.

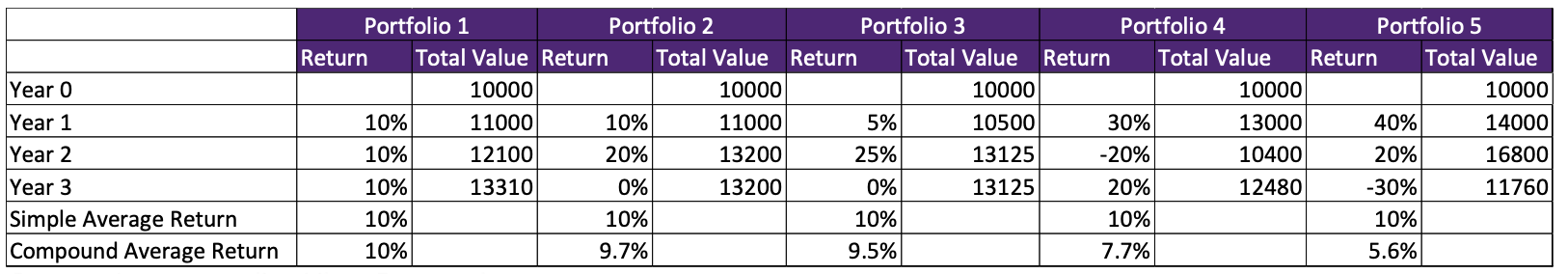

A portfolio’s compound return declines when returns become more dispersed from the average return of that portfolio; higher volatility of returns correlates with a greater drop in compound returns. The table below3 illustrates this nicely.

Source: Investopedia, Aikya Research

Source: Investopedia, Aikya Research

It shows that whilst Portfolios 1, 2 & 3 have the same average returns, Portfolio 3 displays the highest dispersion of returns, and therefore the lowest long-term compound average return. Alternatively, Portfolio 1 displays the most stable returns with zero volatility, which explains why its compound average return is the highest within the group.

Negative drawdowns detract from the positive compounding of portfolio returns. Portfolio 4 and 5 illustrate this effect. Having experienced a 20% capital loss in year 2, Portfolio 4 requires at least a 25% return in year 3 just get back to where it was at the beginning of year 2.

The Promise of Emerging Markets

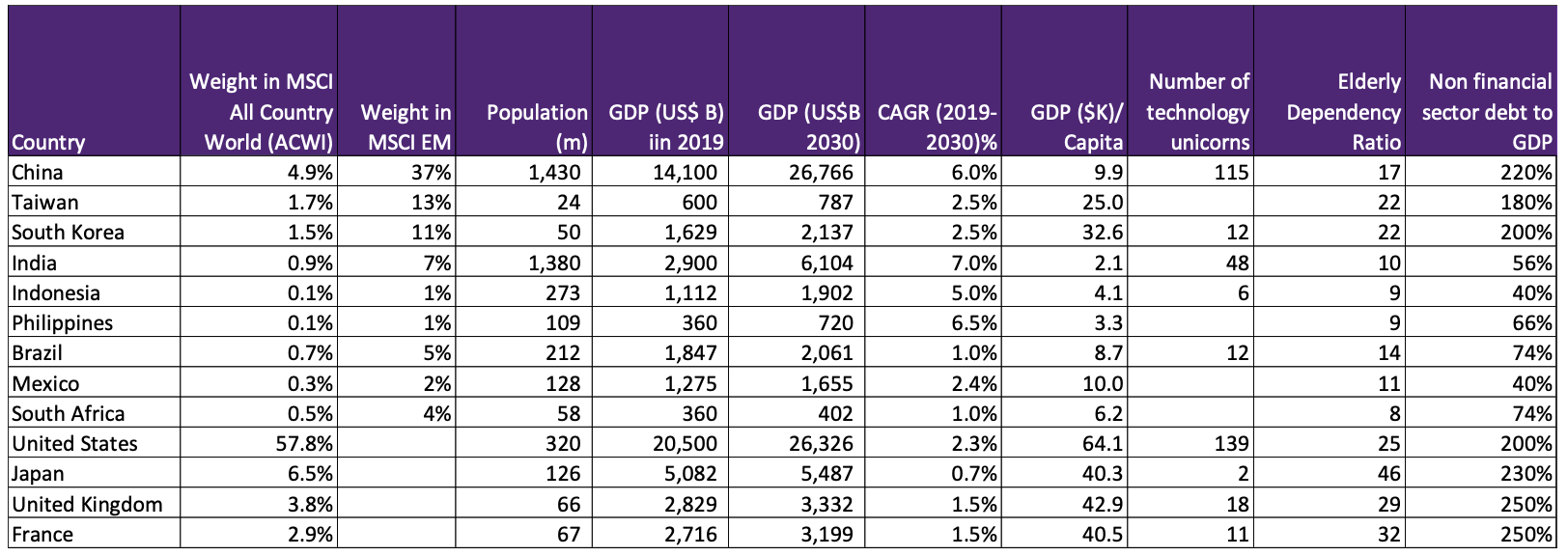

Emerging Market (EM) countries account for almost 80% of the world’s population, 60% of global GDP and the majority of its incremental growth, but less than 15% of global market capitalisation. Moreover, EM countries have favourable demographics and start from a lower level of economic development (GDP/Capita), meaning they are likely to become even more dominant in global economic activity over the next decade. Because of their younger populations, they are also likely to be at the forefront of Internet-driven transformation within various industries, as younger people are more amenable to technological change. Disruptive business models4, which create long-term opportunities for investors, are more likely to come from Emerging Markets.

Source: MSCI, CIA World Factbook, Bank of International Settlements, Wikipedia

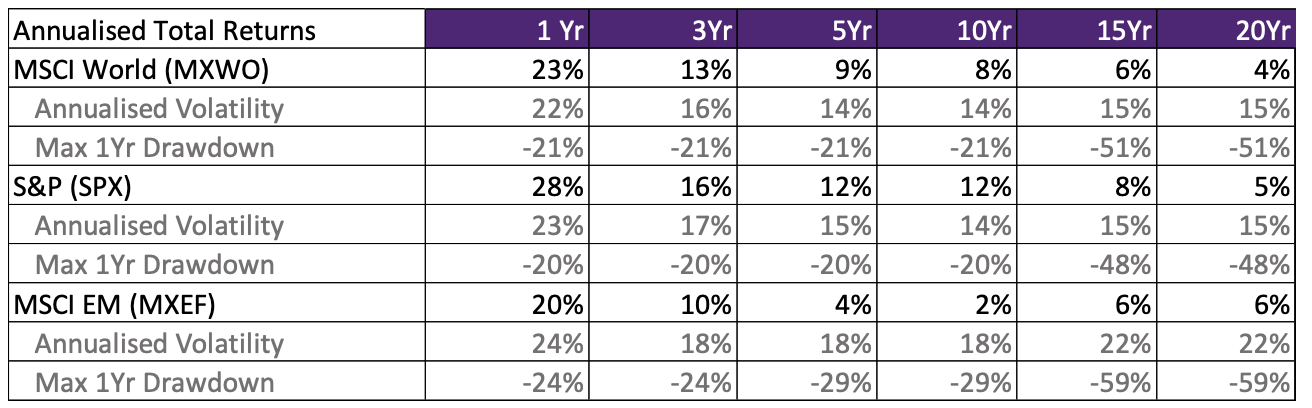

Despite such a strong economic backdrop, the investment performance of Emerging Markets over the past decade has been mediocre. The MSCI EM index has underperformed both the S&P and MSCI World indices over the last decade. Even over the past 20 years, MSCI EM has delivered annualised returns that are very similar to S&P, but with much higher volatility and sharper drawdowns.

Source: Aikya research, Bloomberg, as of December 31st, 2020.

Emerging Markets are called ‘emerging’ for a reason. While the promise of future growth is attractive, these markets suffer from various macroeconomic vulnerabilities, governance challenges and weak institutional structures. Given their volatile nature, these markets typically appeal more to the risk-seeking ‘lottery’ type investor behaviour. It is worth explaining in more detail why this appears to be the case:

- A significant part of the MSCI EM index consists of large industrial conglomerates or mega financial institutions (typically state-owned), which usually trade at attractive valuations. Investors constrained by the benchmark, or investors with a classic value mindset get attracted to these companies, without fully appreciating that these companies are seldom run with the interests of minority shareholders in mind. These are often poor-quality franchises with low pricing power that generate mediocre returns on capital.

- At the other end of the spectrum, there are many companies in EM whose business models are more conceptual in nature. Even though many of these ‘concept’ companies are yet to generate profit, investors are willing to give the benefit of the doubt for the promise of tomorrow. They see these large and growing EM populations as huge addressable markets, with the potential to make money for these conceptual companies in the future.

- EM economies are more reliant on the manufacturing and resources sectors, which make them inherently more cyclical when compared to developed market economies that are more driven by domestically oriented service industries. Macroeconomic cycles within EM economies also tend to be amplified by relatively immature monetary and fiscal regimes, leading to higher volatility and deeper drawdowns.

- Many EM countries suffer from weak rule of law and offer little respect for private property rights. The general quality of institutions is poor, and they often restrict the repatriation of foreign capital. As a result, stocks in riskier EM countries often trade at relatively attractive prices, which appeals to investors from time to time.

In the context of an investment universe as volatile and risky as EM, an investment approach focused on downside risk protection and controlling volatility becomes even more powerful for the long-term compounding of returns.

The importance of steady compounding

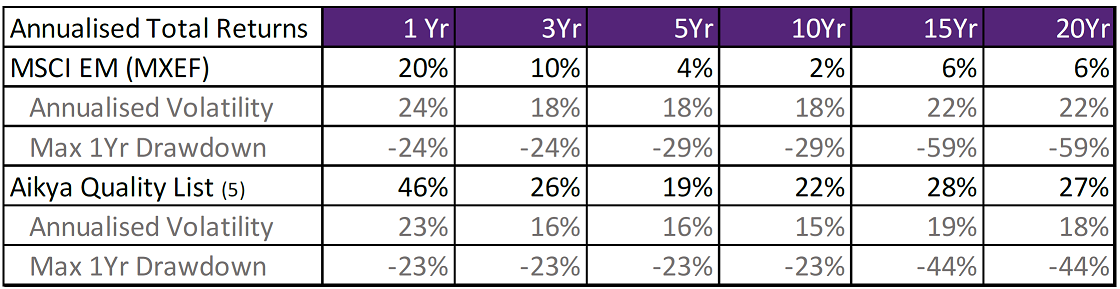

The Aikya Quality List (QL) is made up of EM companies that have passed our Stewardship, Franchise and Financial quality tests. Historically these companies have compounded investment returns at a significantly higher rate vs MSCI EM going back 20 years5.

Source: Aikya research, Bloomberg, as of December 31st, 2020.

Past performance is not a reliable indicator of future results. The Table is shown for informational purposes and is not intended to represent the returns that may be achieved by Aikya’s investment strategy and process.

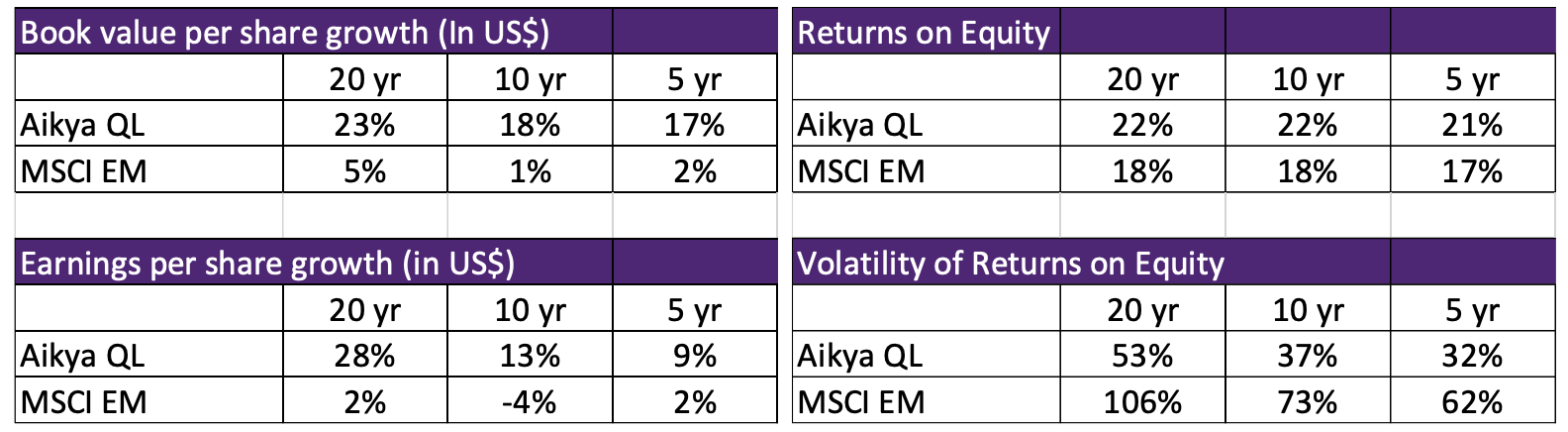

This outcome has been achieved through superior earnings and book value per share (BVPS) growth, with a much lower volatility of Returns on Equity (RoE) vs the broader MSCI EM benchmark.

Source: Aikya research, Bloomberg, as of December 31st, 2020.

Past performance is not a reliable indicator of future results. Table is shown for informational purposes and is not intended to represent the returns that may be achieved by Aikya’s investment strategy and process.

We believe that the best way to invest in Emerging Markets and capitalise on the significant economic potential of these countries is to invest in the types of companies on the Aikya QL. The names that make it to the Aikya QL display the following characteristics:

Strong Stewardship

We like companies with strong principal owners. These are the people with ‘soul-in-the-game’ who are emotionally invested in their companies. The health of the company not only drives their net-worth, but also their entire sense of self-worth. A permanent owner-mindset enables them to make decisions which are likely to strengthen the business in the long-run, without falling for the typical short-termism that we see in many listed companies with no major shareholder.

But just finding owner-led businesses is not enough. We look for owners who have a strong sense of integrity and practise best-in-class governance. An organisational culture that is aligned to the strategy is another important factor for us, as is the ability of these principal owners to demonstrate a history of disciplined and conservative capital allocation. Well-stewarded businesses improve with time, as they have an ability to evolve and better service their customers. They also typically thrive during macroeconomic downturns because they can behave counter-cyclically when times are tough.

Good stewards also align their businesses with the interests of all stakeholders, including the communities they serve, the environment, employees, and the government. We firmly believe that the business groups that contribute positively to the sustainable development of these emerging economies are likely to be the long-term winners.

Resilient Franchise

Anti-fragility6 is the key quality we are looking for in our companies. We ask a number of questions, namely, how resilient are the returns of the business? How vulnerable are they to macro-economic cycles or disruption linked to long-term structural shifts within an industry? Does the industry structure allow them to make strong returns on capital? Is their competitive moat strong enough to prevent new competition, and is their competitive advantage durable?

While all our companies are exposed to excellent long-term growth opportunities, we are not necessarily looking for the highest growth or the highest return businesses in our universe. Rather, the sustainability of growth and returns is lot more important to us. In fact, we tend to be extra cautious when analysing hyper-growth companies, as very fast growth is usually the result of undue risk taking in a fast-changing industry, which makes such companies more vulnerable to disruption.

Sound Financials

We eschew companies with leveraged balance sheets. There is no company on the Aikya QL with leverage of more than 2x Net Debt/EBITDA, and the financial institutions we like are usually the most capitalised and liquid entities amongst their peer group. We specifically avoid the companies with a mismatch between foreign currency debt on their balance sheets and local currency cash flows.

We have a zero-tolerance policy on poor quality or questionable accounting, which has served us well in the past. We tend to avoid companies where the accounts are not entirely transparent, or where we suspect aggressive accounting by the management team.

Valuation

We adopt strict valuation discipline, in the belief that our ability to protect downside is driven by not overpaying for these high-quality stocks. Using valuation as a guide, we regularly avoid the most popular parts of the market and are willing to invest in high quality companies that might be temporarily out of favour. Our valuation approach, which is holistic and long-term, attempts to assess how much a business might be worth in 10 years’ time.

Portfolio Positioning

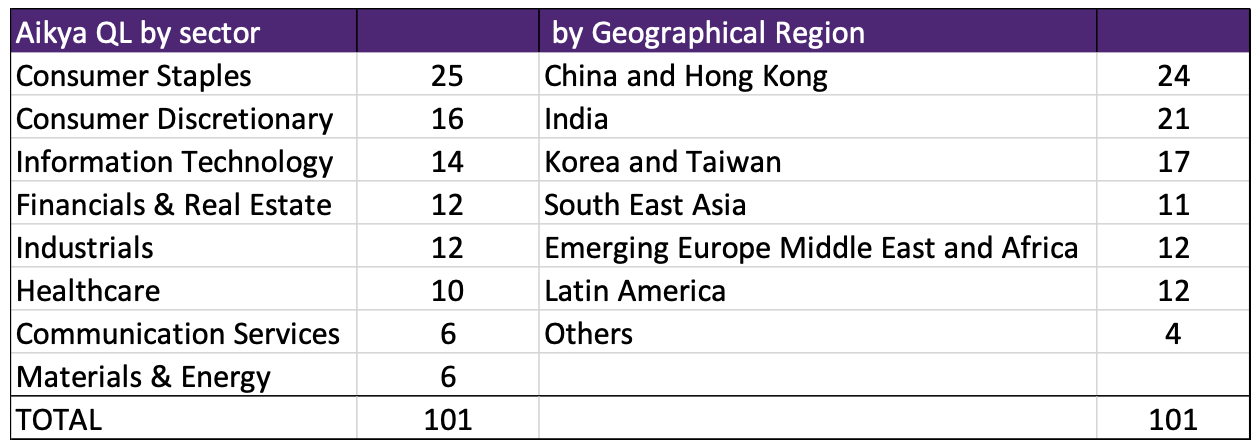

The portfolio consists of 30-35 sensibly priced companies from the Aikya QL. We are focused on maximising risk-adjusted returns for our clients and are not constrained by any benchmark weights.

Country allocation

Our investment process is entirely bottom-up. We are primarily focused on company research, and do not attempt to second guess macroeconomic forecasts. We believe that a portfolio of well-stewarded businesses can compound capital irrespective of macro uncertainties, because strong businesses tend to get stronger during downturns.

However, we struggle to find investment ideas in countries where factors crucial to long-term sustainable economic development are missing. Accordingly, we struggle to invest in companies operating in countries with weak rule of law, questionable respect for private property rights, and low-quality institutional structures.

We also think about appropriate diversification at a portfolio level. But we find traditional GICS7 sector/country classification to be not especially useful when it comes to thinking about diversification within EM portfolios. Instead, we look at the long-term drivers of companies and try to diversify our portfolio based on these underlying drivers. For example, Banco de Chile which operates in a small resource-exporting economy like Chile is far more dependent on the resources cycle than to its banking peer in India, Kotak Mahindra Bank, which is largely driven by the domestic drivers of the Indian economy.

China

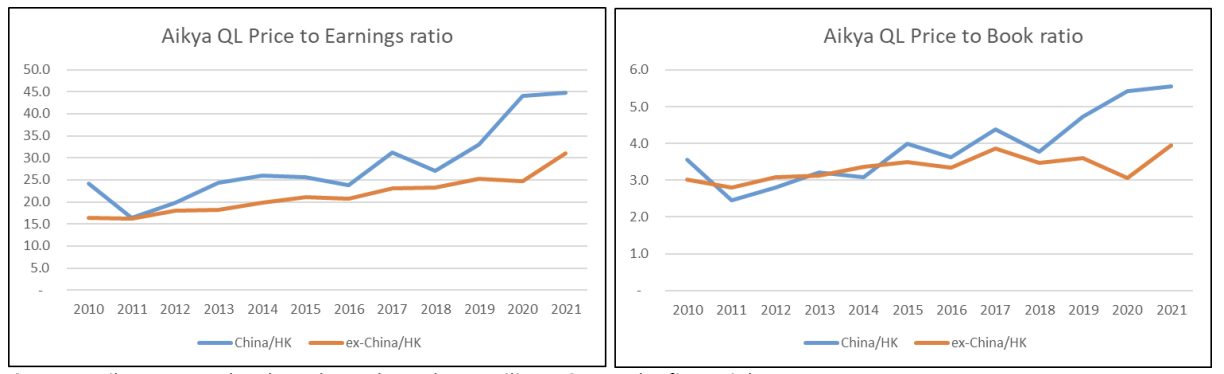

The unconstrained nature of our portfolio construction is especially important in the context of Emerging Markets. Certain countries get very popular from time to time, which often results in bubble-like valuations in companies listed in these countries. We believe China could be going through such a phase at the moment. Its stock markets have become extremely expensive, both relative to their own history as well as in comparison to the rest of the universe. Its popularity has been shaped by a recognition that the country has contained COVID-19 better than most other EM countries, and the Chinese Central Bank has facilitated very loose monetary conditions in order to fight off any potential slowdown in Chinese exports. As the COVID-19 situation eventually normalises, we believe much of this valuation premium for Chinese stocks is likely to disappear.

Source: Aikya research, Bloomberg, based on trailing 12 months financials.

The Aikya Portfolio looks under-represented in China currently, but this is very much a tactical position due to the poor risk-reward of owning Chinese equities. As evidence, China is the most represented country on the Aikya QL. If the valuations were to become more reasonable, we would naturally increase our allocation to China.

Source: Aikya research

India

Indian companies on the other hand represent almost 23% of the portfolio, so it’s worth asking if we are taking too much risk on the macroeconomic situation in India. We do not think so, because half of our Indian positions are exporting businesses such as Tata Consultancy Services (TCS), and even the domestically exposed portfolio positions such as Marico have pricing power and are not particularly linked to macro-economic cycles.

Sector Positioning

Given our focus on owning well-governed businesses, we tend to stay away from state-owned enterprises (SOEs) and politically connected businesspeople. We have a bias towards owning businesses that are owned by genuinely private entrepreneurs. In our universe, this often drives us towards consumer sectors, and keeps us away from more cyclical, capital intensive sectors such as Energy, Industrials and Materials.

Technology, Internet, and e-commerce stocks are under-represented in the portfolio at the moment, but largely due to valuation reasons.

Performance Review

One year is too short a period to comment, but our performance so far has followed an expected path. In absolute terms, returns have been strong, and have displayed lower volatility than the market. Since its inception in March 2020, the Aikya Global Emerging Markets (GEM) strategy has returned 26.3% in US$, compared with the MSCI Emerging Markets benchmark which was up 29.6% during the same period.

We have shown strong downside protection in periods of market weakness, and as expected, slightly lagged in very strong conditions. During the months of March 2020, September 2020 and March 2021, when the markets returns were negative, the Aikya GEM strategy outperformed the benchmark.

While market returns were driven by just a few stocks concentrated in the Internet, E-commerce and Information Technology sectors, the Aikya GEM strategy benefited from strong performance from a diverse range of stocks across various sectors, such as Industrials, Information Technology, Consumer Staples, Financials and Consumer Discretionary. This is very consistent with our prudent and diversified risk managed approach to running portfolios. As the valuations of a few of these previously high-flying companies on our Quality List (particularly in Internet and China) become more reasonable, we expect to add them to our client portfolio.

Past performance is for illustrative purposes only and is not indicative of future performance.

1https://en.wikipedia.org/wiki/Low-volatility_anomaly

2https://www.advisorperspectives.com/articles/2020/10/12/who-buys-lottery-stocks-youll-be-surprised

3https://www.investopedia.com/articles/06/compoundingdarkside.asp

4https://en.wikipedia.org/wiki/List_of_unicorn_startup_companies

5Based on back testing performance of equal weighted portfolio of companies currently in Aikya QL

6https://en.wikipedia.org/wiki/Antifragility

7https://www.msci.com/gics